-

Nachiket Mhatre

27th Jul 2012

When India decided to tread along the path of Nehruvian socialism and the Licence Raj, it left us with the most unfortunate blend of capitalism and communism. That's terrible for geeks and gadget lovers, because it results in locally-manufactured products that adopt a capitalist pricing model and a communist approach to features and quality. If you try and get around that by procuring gadgets from First World countries, protectionist government policies cut in with hefty import duties and miles of red tape.

Nevertheless, it's hard to resist the dual benefits of superior quality and ridiculously low prices (in some cases) that these imports entail. Although online shopping has made it easy to obtain stuff from across the globe, fear and ignorance of the duties involved and the huge bureaucratic entanglement that might ensue prevents most people from taking the plunge. Fear not, because I'm going to put my extensive research and experience — stemming out of spending an embarrassing amount of money importing goods online — to save you a lot of time, cash, and heartburn.

Will every purchase attract import duty?

No, you can import goods worth Rs 2000 duty-free. Furthermore, this duty exemption is bumped up to Rs 10,000, provided the item is marked as a "gift".

This gift loophole sounds appealing. How do I go about it?

Firstly, this practice is unethical and therefore not encouraged. In fact, most web stores in Europe and America will categorically refuse to mark shipments as a gift. However, online shops operating out of Hong Kong are more than happy to do that. Heck, some of them are even willing to bill the items at a fraction of the cost to make it easier for you to evade duty. However, take the higher path and be honest. Remind yourself that you are an upstanding citizen and not Anil Ambani.

Fine, I'll do it by the book. What kind of duty am I looking at?

The maximum Customs duty imposed is 40%, plus an additional duty of 2%. In my experience, however, the duty has ranged from a minimum of 25% for non-electronic goods to anything between 35-40% for electronics and toys. At times, you can even be charged with "handling charges" running into a few hundred rupees.

Sweet Bal Krishna, that's expensive! Tell me more about these Chinese web stores.

It's not just about evading duty, but it's a fact that almost everything nowadays originates from China, and thus is cheaper when sourced directly from there. You will be surprised to know that most of the cool gizmos found on many e-shops (such as ThinkGeek.com) are available for far cheaper on Hong Kong-based online stores such as DealExtreme.com, with free shipping to boot. Make it a habit to double-check if you're buying something that is also selling on these websites. Even Hong Kong based e-shops that don't ship for free offer really cheap shipping options — especially when compared to their European and American counterparts.Also note that paying in British Pounds Sterling is usually more expensive than buying the same item in US Dollars. Having said that, certain items on Amazon.com (USD) will be more expensive than Amazon.co.uk (GBP) because the former has to import them. In a nutshell, it pays to do your research.

Which items are banned for import?

Here's a comprehensive list of the banned items. Having said that, the CBEC (Central Board of Excise and Customs) works in mysterious ways. I have successfully imported several PCB (Printed Circuit Boards) on several occasions for my DIY projects, even though they are on the list of banned items. I have also been charged no duty for items that were worth well over the duty-exemption limit, whereas in some instances I have had to pay up for those that should have been exempt. Expect anything.

How do I pay the duty levied on my shipment?

If you choose regular mail as the shipping method, the local post office delivers your package after the Customs department has appraised it for duty. The postman will give you a receipt bearing the details and will collect the amount from you. The procedure is the same for commercial courier agencies such as FedEx and UPS (not to be confused with USPS — The US Postal Service), except that you get a duty estimate and a polite telephonic reminder to keep the cash handy. Alternatively, Amazon.com has an agreement with Indian Customs, wherein you have to pay the duty at checkout itself. This, as you will realise in the course of this FAQ, will save you a lot of headache.

What should I do if the duty has been levied wrongly?

The duty receipt will have details regarding the department handling refunds and grievances. Pay the duty anyway and write a letter to the concerned authority for a refund. I can't say how long the process will take, but don't get your hopes too high.

What kind of shipping method is the best?

That depends on your requirements. For expensive and urgent shipments, it's best to choose reliable courier services such as UPS and FedEx. They are expensive, but there is virtually no risk of your parcel getting stuck in Customs, as they have dedicated liaisons to ensure smooth delivery. More importantly, the process is speedier and more reliable because the local postal department is taken out of the loop.On the flip side, whenever I've chosen the cheapest shipment option, I've found that even dutiable items can sometimes fly under the radar. One can deduce that the Customs Department may have treated these parcels as low priority, leading to decreased chances of attracting a duty. Please note that these are merely empirical observations, and your mileage may vary.

Generally, it's a good idea to choose the cheapest mode of shipping if speed isn't a concern. Just make sure that you choose an option that provides a tracking number. If you're concerned about the security of your shipment, it will be reassuring to know that I haven't lost a single parcel in all my years of online purchases.

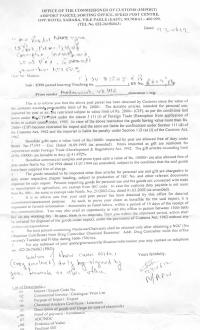

Help, my shipment hasn't arrived for several weeks! What do I do? Ideally, this never happens for courier services, but such instances are quite common for postal deliveries. In reality, shipping takes less than a couple of days, even for the cheapest delivery options. The inordinate delays can be attributed to Customs procedures. Generally, these packages are stuck in appraisal and awaiting action from the importer (that would be you). When this happens, the department sends you a letter seeking certain documents (proof of purchase, invoices) and \ or a written undertaking. In your case, the letter either may have been lost or probably not dispatched at all (unsurprisingly, a highly common occurrence). A sample of one such letter can be seen alongside (click on the thumbnail).

Ideally, this never happens for courier services, but such instances are quite common for postal deliveries. In reality, shipping takes less than a couple of days, even for the cheapest delivery options. The inordinate delays can be attributed to Customs procedures. Generally, these packages are stuck in appraisal and awaiting action from the importer (that would be you). When this happens, the department sends you a letter seeking certain documents (proof of purchase, invoices) and \ or a written undertaking. In your case, the letter either may have been lost or probably not dispatched at all (unsurprisingly, a highly common occurrence). A sample of one such letter can be seen alongside (click on the thumbnail).In such instances, the shipment tracking system will show that the parcel has arrived at the Customs department and is awaiting clearance. Beyond this point, the original tracking system becomes useless. To locate your package within the Indian system, you need to contact the Foreign Post Office (FPO) designated for your city. Refer to the comments section in this link for comprehensive, if slightly outdated, list. If you happen to live in Bombay, keep your tracking number handy and call the Customer Service Department on 022 - 2261 1791. The FPO rep will tell you exactly where your shipment is stuck and what should be done to get it moving again. However, if the line goes to an answering machine, you can contact the good people in the Sorting Department by calling 022 - 2262 0756.

I hope this information proves a good starting point for your future travails with the Indian Customs. If you get slapped with a duty that you consider excessive, you can always look up a Clearing & Forwarding agent in your locality using an online directory. Using his "setting" with the Customs officers, he will be able to get you a good reduction on the required duty. Good hunting.

Guide: All You Need To Know About Importing Gadgets Online | TechTree.com

Guide: All You Need To Know About Importing Gadgets Online

A comprehensive FAQ explaining how to navigate through the complicated labyrinth that is Indian Customs.

News Corner

- DRIFE Begins Operations in Namma Bengaluru

- Sevenaire launches ‘NEPTUNE’ – 24W Portable Speaker with RGB LED Lights

- Inbase launches ‘Urban Q1 Pro’ TWS Earbuds with Smart Touch control in India

- Airtel announces Rs 6000 cashback on purchase of smartphones from leading brands

- 78% of Indians are saving to spend during the festive season and 72% will splurge on gadgets & electronics

- 5 Tips For Buying A TV This Festive Season

- Facebook launches its largest creator education program in India

- 5 educational tech toys for young and aspiring engineers

- Mid-range smartphones emerge as customer favourites this festive season, reveals Amazon survey

- COLORFUL Launches Onebot M24A1 AIO PC for Professionals

Reader Comments (62)